Summary

The Exciting Progress Trumps Big and Beautiful Bill is a major legislative package introduced during the Trump administration that seeks to make permanent the 2017 tax cuts while incorporating new pro-growth economic policies aimed at benefiting manufacturers, small businesses, and American families. Promoted as a significant victory for economic growth, the bill proposes substantial tax relief, including up to $13,300 more in annual take-home pay for a typical family of four and notable reductions in tax burdens for middle-income earners. Its provisions also include raising the cap on state and local tax (SALT) deductions temporarily and allocating funds to stabilize rural hospitals, reflecting attempts to address both urban and rural economic concerns.

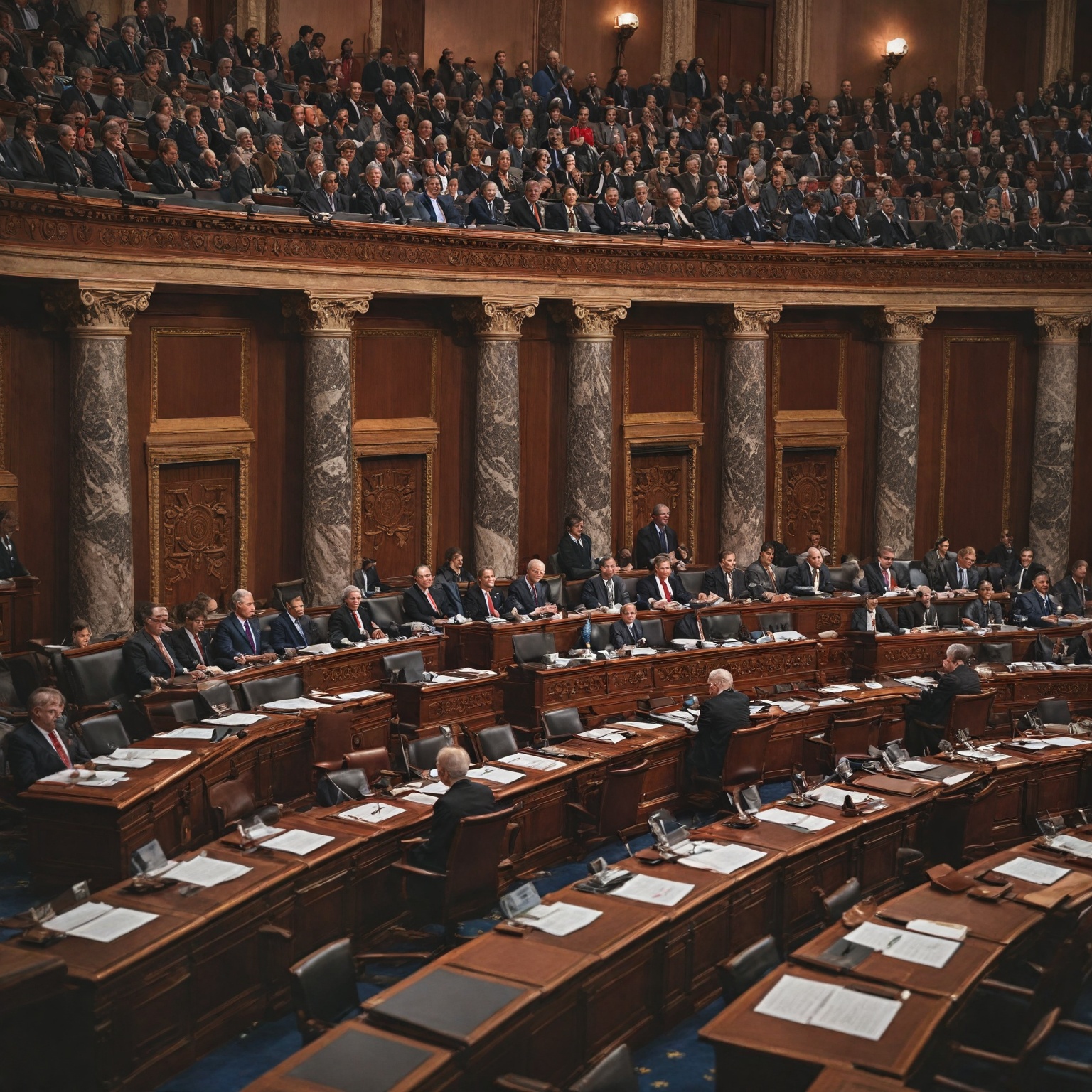

The bill’s journey through Congress was marked by intense political negotiation and procedural hurdles, particularly in the Senate, where the filibuster and other rules traditionally grant significant power to the minority party. Despite initial opposition from key Republican senators and unified Democratic dissent, leadership successfully leveraged the budget reconciliation process to overcome a critical Senate procedural vote by a narrow 51-49 margin, allowing debate and paving the way for final passage. This achievement was widely viewed as a dramatic and pivotal moment in advancing the administration’s legislative agenda amid a polarized political environment.

Controversy surrounding the bill has been significant, focusing largely on its Medicaid work requirements, which critics argue risk reducing healthcare coverage for vulnerable populations, and concerns about the bill’s long-term fiscal impact, with estimates projecting trillions in added national debt. Opposition also emerged from within the Republican Party, highlighting ideological divides over welfare reform and spending priorities, while industry experts raised alarms over reduced support for emerging energy technologies, warning this could hinder U.S. competitiveness. Prominent figures such as Elon Musk publicly criticized the bill for its economic and environmental implications, underscoring the contentious public debate it sparked.

Following the Senate procedural breakthrough, efforts to reconcile House and Senate versions of the bill continued amid ongoing factional disputes and concerns about its cost and policy details. The bill’s future remained uncertain as lawmakers grappled with balancing economic stimulus goals against fiscal responsibility, legal challenges related to procedural compliance, and the complex dynamics of bipartisan negotiation in a deeply divided Congress. The legislative process exemplified the challenges of enacting major policy reforms in the modern U.S. Senate while highlighting the evolving role of Senate traditions such as the filibuster in shaping national policy outcomes.

Background

The legislative process surrounding the One, Big, Beautiful Bill was marked by significant political maneuvering and debate, reflecting the polarized environment in Congress. The bill, which aims to make permanent the 2017 Trump tax cuts while introducing new pro-growth policies, was seen as a major victory for manufacturers, small businesses, and American families due to its projected economic benefits, including substantial tax cuts and increased wages for millions of Americans. Specifically, the bill proposes up to $13,300 more in take-home pay for a typical family of four and promises a double-digit percentage decrease in tax bills for Americans earning between $30,000 and $80,000.

Despite the strong support from various business groups and grassroots organizations, the bill faced considerable challenges in the Senate. Unlike the House of Representatives, where a numerical majority can often expedite legislation, the Senate’s rules favor extended deliberation and provide individual Senators with significant procedural leverage, often resulting in filibusters and delays. However, certain types of legislation, such as budget-related measures including budget-resolution and budget-reconciliation bills, are designed to be immune from filibusters, which has influenced the Senate’s handling of the bill.

Key points of contention included Medicaid work requirements, which were considered the strictest ever proposed by Republicans and raised concerns about coverage losses for many Americans. Additionally, the bill sought to increase the cap on state and local tax (SALT) deductions from $10,000 to $40,000 temporarily, a provision that played a critical role in securing support from Republican senators representing Democratic-leaning states. To address concerns about rural healthcare, the legislation also allocated $25 billion to stabilize rural hospitals amidst the proposed Medicaid restrictions.

Negotiations involved a mix of high-profile lawmakers from both parties and other stakeholders, underscoring the complexity of reaching a bipartisan agreement amid ongoing political challenges such as impeachment proceedings and stalled legislative initiatives. The passage of the bill through the House marked a pivotal moment, but the Senate’s consideration remained a crucial hurdle in the bill’s journey to becoming law.

Legislative Journey

The legislative journey of President Donald J. Trump’s One Big Beautiful Bill began with its introduction in Congress, where the idea for the bill originated either from sitting members of the U.S. Senate or House of Representatives, or was proposed during election campaigns. Additionally, citizen groups and individuals petitioned members of Congress to recommend new or amended laws, contributing to the bill’s initial conception. Upon introduction, the bill was assigned to relevant committees responsible for researching, discussing, and making amendments before it was put to a vote in the originating chamber. After passing one chamber, the bill proceeded to the other body of Congress to undergo a similar process of committee consideration and floor voting.

The bill contained critical measures designed to support main street businesses, enhance America’s global competitiveness, and foster sustained economic growth. The Chamber of Commerce publicly commended Speaker Johnson for his leadership in advancing the bill, emphasizing the importance of preserving President Trump’s pro-growth tax reforms. The Chamber also encouraged the Senate to expedite its consideration to deliver lasting benefits for American workers and businesses.

In the Senate, the bill faced procedural challenges reflective of the chamber’s rules, which favor extended deliberation and provide significant procedural leverage to individual Senators. Majority party leaders in the Senate are generally expected to propose items for consideration; however, the formal tools to enforce action are limited compared to those in the House, where the majority party can process legislation more swiftly.

On June 29, 2025, the Senate voted 51-49 to proceed to debate on the bill, a motion that was met with opposition from two Republicans who joined all Democrats in dissent. This close vote underscored the bill’s contentious nature and the ongoing political struggles within the Republican caucus. Despite this, party leaders negotiated majority support sufficient to open the floor debate, though the ultimate fate of the bill on the Senate floor remained uncertain due to internal disagreements and persistent opposition from some Republican senators.

During the Senate proceedings, clerks completed a marathon reading of the entire domestic policy package, signaling the commencement of formal floor debate. Concurrently, the Senate addressed procedural concerns raised by Democrats, particularly regarding the calculation of the bill’s costs. The legislative process reflected a broader pattern of negotiation and compromise within a polarized Congress, where integrative bargaining and logrolling have been utilized in past instances to create legislative value and facilitate bipartisan agreements.

Throughout the process, the bill was championed by key negotiators including the Senate Majority Leader, Senate Minority Leader, several Senators from both parties, the White House Legislative Affairs representative, and stakeholders such as the president of an autonomous vehicles interest group, demonstrating the complex coalition-building efforts necessary for advancing major legislation.

The bill’s progress also highlighted the enduring significance of Senate traditions such as the filibuster. While the filibuster has faced increasing limitations through exceptions carved out over recent years, it remains a potent tool for the Senate minority to influence legislative outcomes. Certain types of legislation, including budget-related measures and specific confirmations, are exempt from filibuster rules, but bills like One Big Beautiful Bill continue to encounter procedural hurdles that require majority negotiation and strategy to overcome.

Overcoming the Senate Obstacle

The passage of President Donald Trump’s signature domestic policy legislation, commonly referred to as the “Big, Beautiful Bill,” faced a significant procedural challenge in the Senate. Early debate revealed the fragile nature of support within the Republican ranks, as two Republican senators, Thom Tillis of North Carolina and Rand Paul of Kentucky, joined Democrats in blocking consideration of the measure. This vote underscored the difficulty of advancing a large, complex legislative package through a chamber known for its deliberative rules and procedural hurdles.

Despite this setback, the bill ultimately cleared a key procedural vote by a narrow margin of 51-49, allowing the Senate to proceed with debate and setting the stage for a final vote likely to occur shortly thereafter. Senator Ron Johnson of Wisconsin initially voted against advancing the bill but later reversed his position, reflecting the intense negotiation and strategic maneuvering involved in securing enough support to move forward.

Republican leadership was under pressure to meet a self-imposed deadline of July 4 for passage, emphasizing the urgency of delivering on President Trump’s pro-growth tax reforms and other policy priorities contained within the legislation. The use of the budget reconciliation process was critical to this effort, as it permitted the bill to pass with a simple majority in the Senate, circumventing the 60-vote threshold normally required to overcome a filibuster.

The narrow margin and the involvement of bipartisan opposition highlighted the contentious nature of the bill and the procedural complexity of advancing major legislation in the Senate. Nonetheless, the successful overcoming of this Senate obstacle was hailed by supporters as a significant step toward enacting lasting benefits for American workers and businesses, including protections for real estate and housing incentives that drive economic growth and generational wealth-building.

Role of the Filibuster and Cloture Considerations

The filibuster is one of the oldest and most historically significant traditions in the U.S. Senate, serving as a tool that allows a minority of senators to extend debate and delay or block legislative action. Traditionally, the threat of a filibuster necessitates that most bills secure at least 60 votes to advance, effectively requiring a supermajority for passage. This procedural rule has long shaped the Senate’s legislative dynamics by empowering the minority party to influence or stall legislation.

However, in recent years, the influence of the filibuster has been curtailed through a series of exceptions that allow certain types of legislation and nominations to bypass the 60-vote threshold. For instance, budget-related measures such as budget-resolution and budget-reconciliation bills, as well as specific presidential actions under the Congressional Review Act (CRA), are designed to be immune from filibusters. Additionally, both parties have carved out exceptions for executive-branch and lower federal judicial confirmations, with Democrats removing the filibuster for these nominations in 2013, followed by Republicans extending that exception to Supreme Court confirmations in 2017.

The erosion of the filibuster’s reach has significant implications for the legislative process. Without the looming threat of a filibuster, the majority party can pass even ambitious policy changes by a simple majority vote, reducing the necessity for bipartisan compromise and enabling more rapid enactment of its agenda. This shift has played a crucial role in overcoming major Senate obstacles and advancing key legislation, exemplified by recent legislative efforts such as the Exciting Progress Trumps Big and Beautiful Bill.

Impact and Reactions

The passage of the One Big Beautiful Bill (OBBB) has elicited a wide range of responses from political leaders, experts, and industry stakeholders, reflecting deep divisions over its fiscal and policy implications. Among the most vocal critics is Elon Musk, who denounced the bill as an “abomination” that would lead to “crushing” national debt, highlighting concerns about the potential economic consequences of the legislation. Similarly, Republican Senator Rand Paul of Kentucky expressed opposition, warning that the bill would cause the debt to “explode,” with estimates indicating an increase of $3.1 trillion including interest.

Within Congress, the bill has proven to be a source of intense negotiation and internal strife, particularly among Republicans. Some House Republicans have opposed key provisions—most notably the deep cuts to Medicaid—foreshadowing a difficult vote in the lower chamber given the narrow majorities held by party leaders such as Senate Majority Leader John Thune and House Speaker Mike Johnson. The contentious nature of the bill has resulted in tense scenes during Senate deliberations, with holdout senators engaging in extended negotiations and private meetings to resolve disputes, ultimately leading to a narrow majority support without unanimous party backing.

The policy content of the bill has sparked significant debate, especially concerning its impact on healthcare. Senator Josh Hawley of Missouri strongly opposed Medicaid cuts, characterizing them as harmful to the working poor and emphasizing the bill’s adverse effects on his state’s Medicaid program. This opposition underscores the broader ideological rifts within the Republican Party and the challenges in balancing fiscal restraint with social welfare provisions.

Beyond the political arena, industry experts have criticized the rollback of support for emerging sectors such as enhanced geothermal energy, warning that such moves are “profoundly short-sighted.” Analysts argue that reducing investment risks ceding strategic advantages to international competitors, particularly China, which has capitalized on earlier support for solar production to establish global leadership. This rollback is seen as contradicting the administration’s stated goals of energy dominance and innovation, with potential negative ripple effects across other sectors.

Despite the polarization, some commentators credit Speaker Johnson for successfully steering the bill through the House, highlighting his role as a “quiet force for conservatives” in advancing tax cuts, welfare reforms, green spending cuts, and border security enhancements. The legislative process has been marked by complex bipartisan negotiations, as demonstrated in comparable cases where multiple perspectives and strategic compromises were necessary to pass significant legislation. However, the bill’s ultimate fate remains uncertain, with ongoing disputes in the Senate and concerns about its broader economic and social impacts continuing to dominate the discourse.

Aftermath and Future Implications

Following the dramatic overcoming of a major Senate obstacle by the “Big and Beautiful Bill,” there was widespread hope that a reconciled version of the House and Senate bills could be finalized promptly. Byrd’s actions reflected this optimism, as many anticipated the formation of a Conference Committee to unify the legislation before Congress adjourned in early August. This optimism was further bolstered by assurances from AASHO’s Johnson to State highway officials that the Fallon Bill, incorporating a compromise financing plan, would ultimately pass.

However, procedural hurdles remained significant. Although the package cleared a critical procedural vote in the Senate, the final passage was still pending, marking the vote as an important test for Majority Leader John Thune. Thune emphasized the urgency of passing the legislation, stating, “It’s time to get this legislation across the finish line”. Yet, internal factional disputes over tax and benefit provisions signaled potential delays, as some lawmakers expressed opposition that could complicate or prolong the bill’s enactment.

Financially, the bill’s expansive tax provisions presented complex challenges. Maintaining existing tax breaks while introducing new ones, such as eliminating taxes on tips and overtime and adding benefits for seniors, was projected to cost $3.8 trillion over the decade according to the Congressional Budget Office’s analysis of the House bill. An analysis of the Senate draft was still pending at the time. These substantial fiscal commitments underscored the difficulties in achieving consensus among lawmakers, especially amid broader concerns about the bill’s long-term impact on the federal budget.

Moreover, there were concerns about potential legal and procedural ramifications. For instance, certain provisions raised alarms regarding financial barriers to the justice system, which could discourage lawsuits and limit legal challenges against the government. The Senate Parliamentarian reviewed these provisions for compliance with Senate reconciliation rules, adding another layer of scrutiny and uncertainty to the legislative process.

Looking ahead, while theoretically the Senate could pass the bill at any time by accepting the House version, practical considerations suggested this would be unlikely before early July, which was already considered an ambitious timeline. The Republican caucus remained divided on key issues, making swift passage challenging. Additionally, coordination between the Department of Defense and the National Nuclear Security Agency was mandated to ensure timely spending plans and procurement notifications, reflecting the bill’s broader implications for federal operations and oversight.